Innovating Digital

Finance Solutions

We are committed to creating products and services that assist individuals & institutions in adopting digital assets and innovating within the increasingly digital world of finance.

Our digital assets portfolio has generated an average return of 300-500% over a 4-year period for our professional investors.

Bitcoin (Btc)

Ethereum (Eth)

Solana (Sol)

Litecoin (Ltc)

Tailored Digital Asset

Solutions for Every

Investor.

Our digital asset platform and investment solutions are designed to meet the unique and diverse needs of individual and institutional investors.

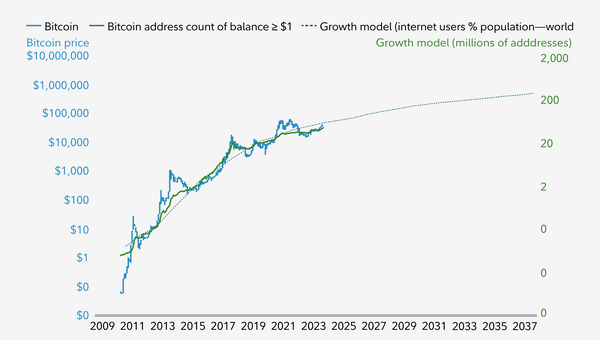

We believe that digital assets are a key pillar in the future of investing.

We have been early adopters of blockchain technology and digital assets solutions dating back to 2016, leading to the current establishment of Sardar Capital Digital Assets.

Our extensive research and development has provided us with the expertise necessary to educate our clients and overcome the obstacles of investing in the digital asset market.

We are providing a reliable gateway for investors looking to gain exposure to digital assets. We offer custom solutions for institutional and retail investors, supporting their long-term financial goals.

Cycle-Centric Investment Strategy

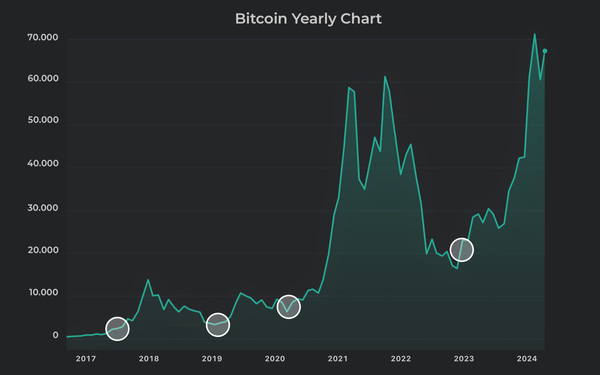

Our primary investment strategy is based on Bitcoin’s four-year halving process, which determines the market cycle for the entire asset class. We aim to buy and sell at the optimal phases of the cycle, maximising returns for our clients.

Cycle-Centric Investment Strategy

Our primary investment strategy is based on Bitcoin’s four-year halving process, which determines the market cycle for the entire asset class. We aim to buy and sell at the optimal phases of the cycle, maximising returns for our clients.